Boonsoft is the closest thing to a software company that I have yet made. Right now, Boonsoft has 2 documents available for download. The core philosophy seems to be one of saving time.

http://www.Boonsoft.Web.Officelive.com

| « | April 2025 | » | ||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | 4 | 5 | ||

| 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 13 | 14 | 15 | 16 | 17 | 18 | 19 |

| 20 | 21 | 22 | 23 | 24 | 25 | 26 |

| 27 | 28 | 29 | 30 | |||

Boonsoft is the closest thing to a software company that I have yet made. Right now, Boonsoft has 2 documents available for download. The core philosophy seems to be one of saving time.

http://www.Boonsoft.Web.Officelive.com

http://nocompetition.blogspot.com

What happens when you combine:

1)perfectcompetition.net business simulation game

2)my expanding capabilities in microsoft excel and VBA

3)google's blogger (and in the future, other google tools)

?

I am learning more about how to use excel tools, and also discovering some universal truths about trading strategies and business. the nocompetition blog is more open to experimentation than the current blog here. I am going to post some of my excel tools and trading strategy ideas, so check it out at http://nocompetition.blogspot.com

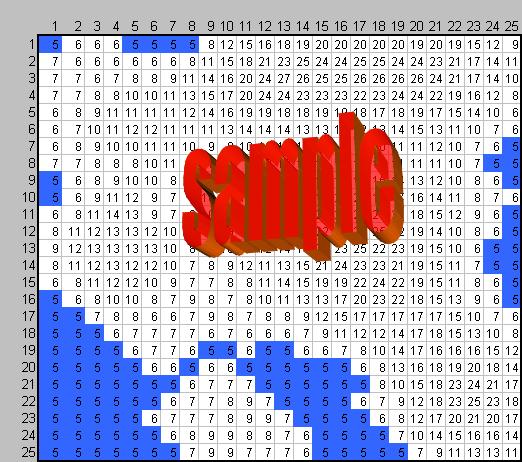

After having found an interesting business simulation game perfectcompetition.net, i have been developing some software tools in excel to make more informative and fun game play. Here is a picture of one of the features I have created:

This particular picture shows the in-game leasehold price that would be offered by the in-game government to a player were a plot of land sold by the government to a player. Land is represented as cells in a grid. Prices shown are in $thousands (in-game currency units). The price equation used is: 5k+1k*neighbors in a 3 square move area(no diagonals). Squares that are priced at 5k are the lowest possible price, and are colored blue.

This excel document of mine performs computations to represent data in another way from that provided in the game, in order to make game-play more fun and efficient. Now if I want to get new data, all I have to do is copy and paste the latest version of the in-game map into my excel document, and the new result will be instantly calculated.

Contact me for a copy (i intend to sell that excel software in-game, so i have not provided it publicly).

view my profile (to the left of your screen) for contact information.

THE SAD MODEL

According to my S.A.D. model of agent characteristics, every agent has 3 characteristics with respect to an event:

Sensor characteristic- ability or cost to get information from their environment about the probability of an outcome of an event.

Actuator characteristic- ability or cost to influence the probability of an outcome.

Demander characteristic- utility or payoff associated with each outcome.

Here is a copy of a paper of mine I brought with me and shared with some individuals at The Institute For Humane Studies' Workshop in Experimental Economics at Bryn Mawr College in July, 2006.

The S.A.D. Model of Agent Characteristics

The particular choice of mathematical model can be for example, a penny mechanism, a vote mechanism, an urn mechanism, a markov mechanism. Other mechanisms are possible, these are only examples of how the S.A.D. model could be applied mathematically.

What I like about the SAD model is that firstly, it is a positive not a normative economic model. It does not take sides. It can be used to run experinomic laboratory games that incorporate prediction markets. The agents are given private information about their own SAD characteristics. This substitutes for example in place of the double oral auction reservation prices given to each player, as famously developed by Nobel Prize winner Vernon Smith. But unlike commodity markets for pounds of apples or quantity of porkbellies, event markets like political markets in the IEM cannot be tackled experimentally using reservation prices. That is why the SAD model is useful. I will again repeat what I said at Bryn Mawr: To the best of my knowledge at this point in time, this is the first and only available model/framework that allows an experimental approach to the study of prediction markets. The SAD model allows the study of a controlled, repeatable artificial event with a probability that is known to the researcher.

What the SAD model does not do is define strategies for the agents. In order to perform a pure simulation using the SAD model, the simulated agents will be defined in terms of their SAD characteristics, but also must be endowed with behavioral strategies.

© 2006 Jonathan Moses Katcher, All Rights Reserved.

The following is a work in progress on an Experimental Economics Engine based on the S.A.D. model as applied to an Urn mechanism.

You will need to enable macros. Open excel. Select Tools>Macro>Security>Medium. Then Close Excel.

Click on the link, and save to your desktop. Close all other open applications. Open SimulatedUrn2.0 and select "Enable Macros".

SimulatedUrn2.0b :an Experimental Economics Engine based on the S.A.D. model as applied to an Urn Mechanism

© 2006 Jonathan Moses Katcher, All Rights Reserved.

I will simply say here that many hours of work went into this before I even started coding in excel.

When agents with actuator abilities enter a population of agents engaged in trading of prediction securities, these information markets can turn into Actuator Markets.

While prediction markets act as information aggregators they simultaneously act as Incentive Distributors.

Moral Hazard is a term used to describe this phenomenon, but from the point of view of an interested party: a frame of preference. Economics (when describing things as they are) is amoral, so cannot take sides on a moral debate. Thus the term moral hazard is fine for the insurance industry from which the term was borrowed, but not sufficient for an amoral discussion of the process. Instead we speak of Actuator Incentives.

Now there can be no doubt in my mind that actuator is the right word to use. On Friday, August 4, 2006, on one of my many internet searches for the word Actuator over the past three years, I came across this paper that used the word actuator in an economic context in 2002, thus predating my use of the word actuator in an economic context (2003-present); This is good, because Gerkey and Mataric's paper reinforces the legitimacy of the term actuator in an economic context. They use the word in a slightly more well-defined/narrowly-defined manner, and specifically within the context of a network of robot 'nodes' they call a Sensor Actuator Network (SAN). They speak of simulation as well as real robots. I was suprised to learn of this acronym, because I had independently developed a similar acronym Speculator Actuator Demander model of agent characteristics (SAD) model of agent characteristics. But now that I have read their paper, It seems that perhaps the word "sensor" is better than "speculator" in getting across the idea of the ability to get information. The biggest differences between my version and their version of ideas are:

1)that they seem to limit themselves to using the word actuator in describing robots, and I want to use the term more broadly in any context with players or agents or people or whatever.

2)I want to think of demander characteristics as being a part of the players themselves, so they have a natural stake in the outcome, not just a market stake that can be traded away. This means their natural preferences can be neutralized by an equal and opposite hedging stake in the market.

They said SAN I said SAD

They said Node I said Agent

They said task I said change in outcome probability

Here is the paper by Gerkey and Mataric that reinforces the use of the word "actuator" in an economic context:

A Market Based Formulation of Sensor-Actuator Network Coordination

Brian P. Gerkey and Maja J. Mataric

http://cres.usc.edu/pubdb_html/files_upload/287.pdf#search=%22SAN%20Gerkey%20and%20Mataric%22

Newer | Latest | Older